Changes in the history of social welfare in Aotearoa New Zealand

A DigitalNZ Story by National Library Services to Schools

This story looks back at some of the significant legislative acts and changes in the history of Social Welfare in Aotearoa New Zealand.

Is the welfare of families the responsibility of the state? New Zealand’s governments have long provided financial support for families in need, but the balance of responsibility has shifted depending on the ruling party’s policies.

Source: Story summary — Family welfare, Te Ara — The Encyclopedia of New Zealand.

Here are some major acts and changes to social welfare in Aotearoa NZ.

1898 — OLD AGE PENSIONS ACT

The Act gave a small means-tested pension to elderly people with few assets who were ‘of good moral character’. Although Germany had earlier introduced a contributory state pension, New Zealand's was the first in the world funded from general taxation. It was one of the major achievements of Richard Seddon’s Liberal government.

The Liberal reforms of the 1890s attracted international interest and seemed to symbolise New Zealand’s egalitarian ethos. The groundbreaking legislation of 1898 was based on the principle that the state had some responsibility for elderly citizens who were not able to provide for themselves.

Source: Events — Old-age Pensions Act becomes law 1 November 1898, NZHistory.

View the Old-age Pensions Act 1898.

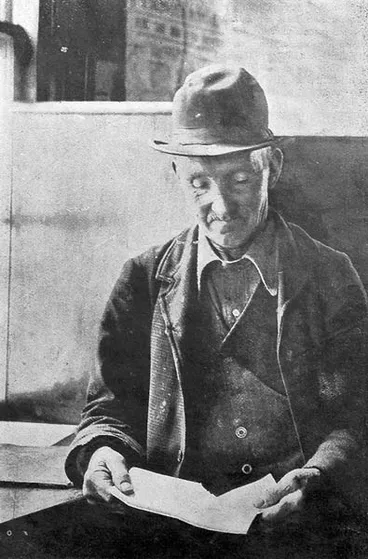

Collecting the pension

Manatū Taonga, the Ministry for Culture and Heritage

OLD AGE PENSIONS. (Mataura Ensign, 15 October 1898)

National Library of New Zealand

Living on a pension

Manatū Taonga, the Ministry for Culture and Heritage

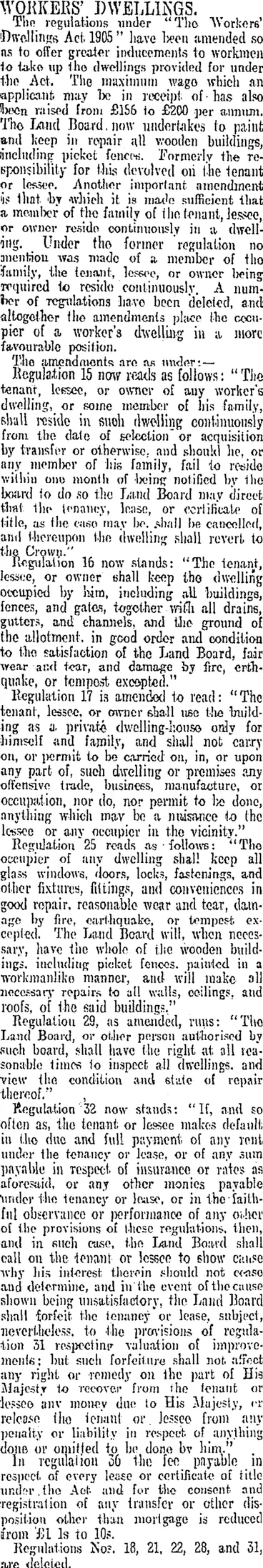

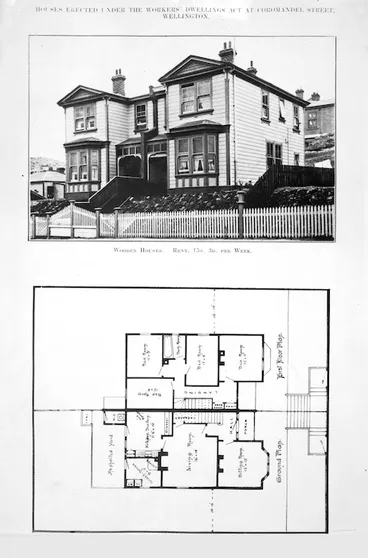

1905 WORKERS DWELLING ACT

In 1905 the Workers Dwelling Act made New Zealand the first nation in the Western world to provide public housing for its citizens. The government built and rented ‘workmen’s homes’, with large gardens, on the outskirts of the main cities. The high quality of these houses, however, meant that the rents charged for them were more than most working people could afford. Also, most of these houses were located beyond the limits of tram and rail systems. Shift workers, especially, could not afford to live far from their workplaces. The government admitted that its pioneering state house scheme was not successful, and all the ‘workmen’s homes’ were eventually sold to private landlords.

Source: Suburbs — The state builds suburbs, Te Ara, The Encyclopedia of New Zealand.

View the Workers Dwelling Act 1905.

WORKERS' DWELLINGS. (Otago Daily Times 21-1-1907)

National Library of New Zealand

Houses erected under the Workers' Dwelling Act, on Coromandel Street, Newtown, Wellington

Alexander Turnbull Library

Plans by architect Fred Barlow for workers' homes to be built in Sydenham under the Dwellings Act 1905

Christchurch City Libraries

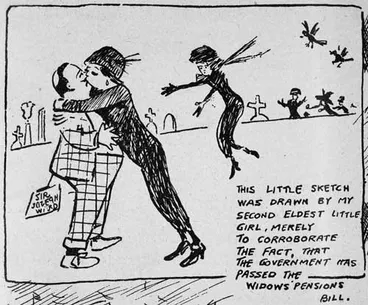

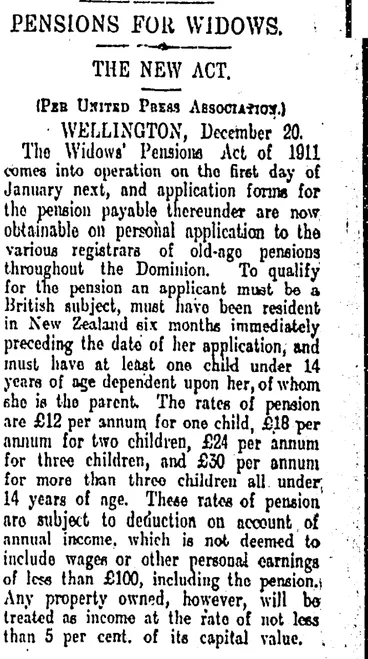

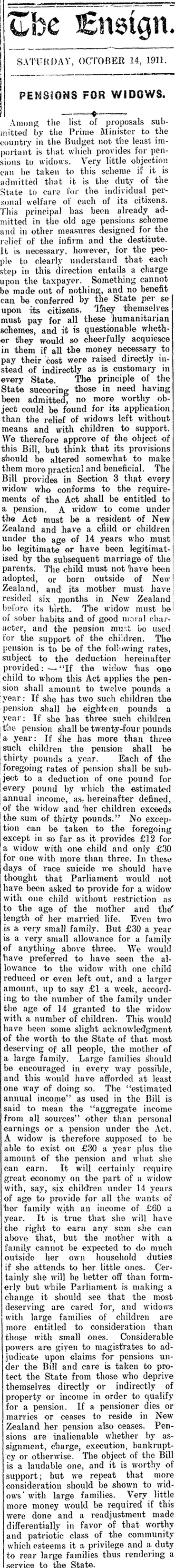

1911 — WIDOWS' PENSIONS ACT

Before widows' pensions were introduced in 1911, widowed mothers with dependent children often had to rely on charity, other family members or their own meagre earnings. Widows' pensions pioneered the principle of state support for women without a male breadwinner.

Source: Family welfare — Widows' pension, 1911, Te Ara — The Encyclopedia of New Zealand.

View the Widows' Pensions Act 1911.

Widows' pension, 1911

Manatū Taonga, the Ministry for Culture and Heritage

PENSIONS FOR WIDOWS. (Otago Daily Times 21-12-1911)

National Library of New Zealand

The Ensign. SATURDAY, OCTOBER 14, 1911. PENSIONS FOR WIDOWS. (Mataura Ensign 14-10-1911)

National Library of New Zealand

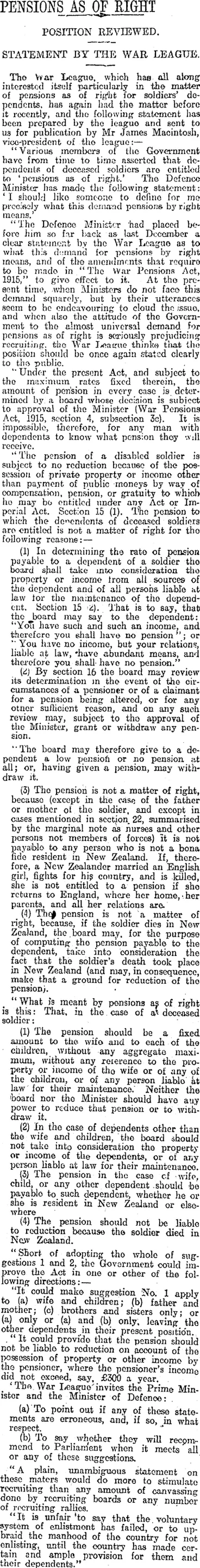

1915 — WAR PENSIONS ACT

In August 1915 the government decided to grant ‘war pensions’ to veterans who returned disabled by their military service, and to the dependants of those who died while enlisted. Veterans and their families applied to the local registrar of pensions, who referred the application to head office for investigation through military records. The pension rates for incapacitation were calculated according to the severity of the injury – the loss of two limbs warranted 100% of the pension, total deafness 70%, the loss of a right hand 65% (a left hand was only worth 60%), and the loss of an index finger 20%. A War Pensions Board would ultimately approve or reject each case.

Source: Public Service at war — Repatriation of returned servicemen, NZHistory.

The War Pensions Act 1943 improved pension rates and made it easier for war veterans and their families to receive compensation for death, disability or financial disadvantage. From 1951 this pension scheme was integrated into the social security system, and veterans qualified for extra benefits such as free travel. Veterans’ associations and the media campaigned for further veteran assistance, and a commission of inquiry recommended a range of improvements in pension rates and conditions. These were incorporated in the War Pensions Act 1954.

Source: Veterans’ assistance — War pensions, Te Ara — The Encyclopedia of New Zealand.

View the War Pensions Act 1915.

PENSIONS AS OF RIGHT (Otago Daily Times 24-4-1916)

National Library of New Zealand

WAR PENSIONS ACT (Otago Daily Times 16-12-1915)

National Library of New Zealand

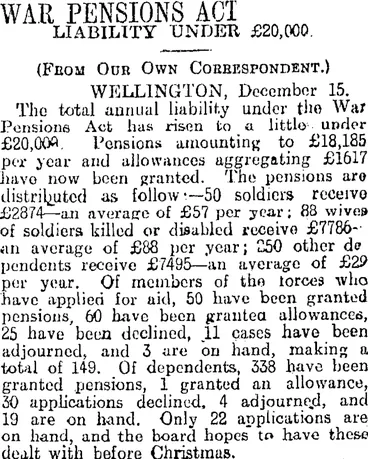

1926 — FAMILIY ALLOWANCES ACT

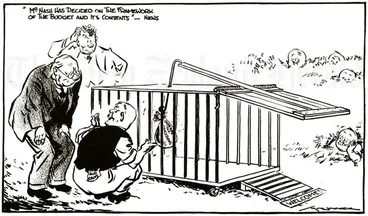

The Family Allowances Act 1926 introduced a means-tested allowance to families with more than two children on incomes of less than £4 a week ($341 in 2009 terms). Men in paid work were supposed to be paid enough to support themselves, a wife and two children – hence no payments were made for the first two children. This cartoon satirises the suggestion that an extra two shillings a week might encourage parents to produce more children. Few households were actually eligible for family allowances.

Source: Family welfare — Family allowances, Te Ara — The Encyclopedia of New Zealand.

View the Family Allowances Act 1926.

Family allowances

Manatū Taonga, the Ministry for Culture and Heritage

FAMILY ALLOWANCES (Evening Post, 09 October 1926)

National Library of New Zealand

TWO SHILLINGS A WEEK (Evening Post, 18 August 1926)

National Library of New Zealand

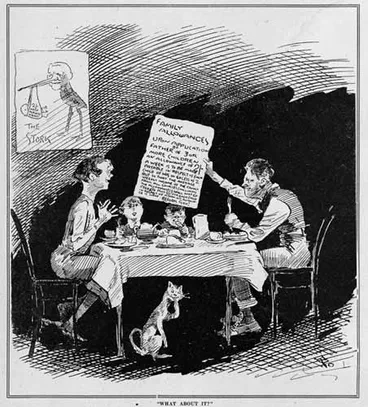

1937 — FIRST STATE HOUSE OPENED IN MIRAMAR

Shot at the opening of the Labour government's first state house in 1937 at 12 Fife Lane, Miramar, Wellington, this image is one of New Zealand's iconic photographs: Prime Minister Michael Joseph Savage lifts a cumbersome dining table through a cheering throng toward the house's threshold. For the government, the Prime Minister's deed was intended to emphasise that he was the servant of 'the people', not above manual labour.

The first tenants of the first state house were David and Mary McGregor. David McGregor was a tram driver for the Wellington City Council. For his efforts he received a wage of £4 7s 9d per week. Out of this total he paid the state £1 10s 3d in rent, just over a third of his pay. In the early 1950s the National government introduced measures enabling state tenants to purchase their home. The McGregors took up the offer and bought, later declaring it to be 'our little bit of New Zealand'.

Source: Health and welfare — State housing, NZHistory.

First State House

Manatū Taonga, the Ministry for Culture and Heritage

State Housing photo album

Archives New Zealand Te Rua Mahara o te Kāwanatanga

FLYING START (Evening Post, 26 May 1943)

National Library of New Zealand

1938 — SOCIAL SECURITY ACT

Labour won the 1935 election on a platform that every New Zealander had a right to a reasonable standard of living. The community was responsible for ensuring that people were not overwhelmed by circumstances against which they could not protect themselves. Labour’s ultimate response to the Depression was the Social Security Act.

The Act combined a new free-at-the-point-of-use health system with a comprehensive array of welfare benefits. It was financed by a tax surcharge of one shilling in the pound, or 5%. Supporters envisaged a scheme that would protect New Zealanders ‘from the cradle to the grave’.

Source: Events — Social Security Act passed 14 September 1938, NZHistory.

View the Social Security Act 1938.

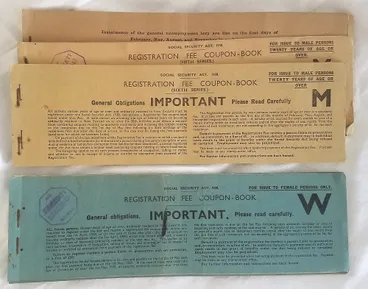

Registration Fee Coupon books

Western Bay District Council

SOCIAL SECURITY (Evening Post, 23 September 1938)

National Library of New Zealand

1946 — UNIVERSAL FAMILY BENEFIT

In 1946 universal family-benefit payments replaced means-tested family allowances, and each mother received some money each week to spend on her children. This meant that all families with children under 16 were now part of the social security system. They were well supported relative to other beneficiaries.

Source: Family welfare — A model welfare state, 1946–1969, Te Ara — The Encyclopedia of New Zealand.

FAMILY BENEFIT (Evening Post, 29 November 1945)

National Library of New Zealand

Evans Family Collection: Mrs Evans collecting the Family Benefit

Palmerston North City Library

Walter Nash’s 1946 Budget

Manatū Taonga, the Ministry for Culture and Heritage

1973 — DOMESTIC PURPOSES BENEFIT ACT

The passage of the Social Security Amendment Act introduced the Domestic Purposes Benefit (DPB) to New Zealand’s social welfare system.

The DPB was intended to help women with a dependent child or children who had lost the support of a husband, or were inadequately supported by him. It was also available to unmarried mothers and their children, and to women who were living alone and caring for incapacitated relatives.

While men could also claim the DPB, the vast majority of beneficiaries were women.

Source: Events — DPB legislation enacted 14 November 1973, NZHistory.

View the Domestic Purposes Benefit Act 1973.

DPB legislation enacted

Manatū Taonga, the Ministry for Culture and Heritage

Single mothers and paid work

Manatū Taonga, the Ministry for Culture and Heritage

Debating state responsibility, 1970s

Manatū Taonga, the Ministry for Culture and Heritage

1977 — GOVERNMENT SUPERANNUATION FUND

In the 21st century most New Zealanders qualified for the old-age pension (national superannuation) from the age of 65. This is funded out of taxation, rather than a social insurance scheme. To qualify people have to be resident in New Zealand at the time of application, have been resident for periods totalling no less than 10 years since the age of 20, and no less than 5 years since the age of 50. It is paid every two weeks, and taxed for those who have other income.

People turning 65 automatically qualify for the SuperGold card, introduced in 2007. Cardholders are eligible for subsidised or free public transport, discounts at some businesses, and concessions on local and central government services.

Source: Older people — Life circumstances, Te Ara — The Encyclopedia of New Zealand.

View the Government Superannuation Fund Contribution Order 1977.

Superannuation advertisement

Alexander Turnbull Library

The first public service superannuation board

Auckland Libraries

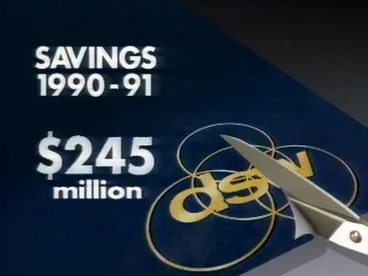

1991 — CUTS TO BENEFIT

In 1991 the National government cut the level of most benefits, including the DPB. Several amendments were also made to DPB eligibility rules, including:

- increasing the qualifying age to 18 in 1991

- introducing new employment expectations after 1995

- a new abatement scheme, which changed the amount deducted from a benefit if the beneficiary earns any other money, in 1996

- enforcing new work tests after 1997.

Source: Family welfare — Family policy, 1980–1999, Te Ara — The Encyclopedia of New Zealand.

[Benefit cut protest, Timaru]

South Canterbury Museum

1991 benefit cuts

Manatū Taonga, the Ministry for Culture and Heritage

1992 — MAJOR RESTRUCTURING OF THE DEPARTMENT OF SOCIAL WELFARE

The Department of Social Welfare was restructured into business units:

- New Zealand Income Support Service

- New Zealand Children and Young Persons Service

- New Zealand Community Funding Agency

- Social Policy Agency

- Corporate Office

[Department of Social Welfare, Timaru]

South Canterbury Museum

Department of Social Welfare

Hamilton City Libraries

Social Welfare Department, Auburn Street, Takapuna.

Auckland Libraries

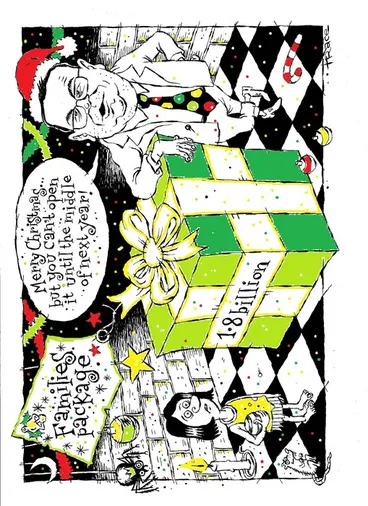

2018 — FAMILIES PACKAGE BILL

A newly elected Labour/New Zealand First coalition government with a confidence-and-supply agreement with the Green Party announced a Families Package in December 2017 that came into effect on 1 July 2018. This package of family support policies built on Working for Families and included a new Best Start tax credit of $60 per week for the year following the birth of every child born on, or after, 1 July 2018. Best Start payments after the child was one year old were related to household income. The Best Start tax credit was also paid to caregivers receiving the Orphan’s or Unsupported Child Benefits and the Foster Care Allowance.

The Families Package increased Working for Families tax credits and Accommodation Supplement payments for some parents and enlarged the number of parents receiving these forms of support.

Source: Family Welfare — Family welfare in the 21st century, Te Ara — The Encyclopedia of New Zealand.

View the Families Package Bill 2018.

Families package: sensible start or short-sighted?

Radio New Zealand

Families package

Alexander Turnbull Library

Families Package 'will lift children out of poverty'

Radio New Zealand

For more on the timeline of events in the history of Social Welfare in Aotearoa New Zealand:

- Social Assistance Chronology – a chronology of social assistance policy and programmes in New Zealand (1844 to 2021).

- History of the New Zealand Welfare System.

This story was curated and compiled by Te Puna Mātauranga o Aotearoa | National Library of New Zealand, Services to Schools staff, April 2022.

![[New Zealand. Social Security Department] :Social security certificate, family benefit. This is to certify that [Violet May Philpott] has been granted a benefit at the rate of 4 shillings a week, payable by equal monthly instalments of £8 8 [shillings] of which the first instalment is that due for the month of [July 1939] payable at the Social Security office or Post-Office at [Miramar]. J H Boyes, Chairman, Social Security Commission. [Form no.] F.B.-6. [Recto. 1939]. Image: [New Zealand. Social Security Department] :Social security certificate, family benefit. This is to certify that [Violet May Philpott] has been granted a benefit at the rate of 4 shillings a week, payable by equal monthly instalments of £8 8 [shillings] of which the first instalment is that due for the month of [July 1939] payable at the Social Security office or Post-Office at [Miramar]. J H Boyes, Chairman, Social Security Commission. [Form no.] F.B.-6. [Recto. 1939].](https://images.digitalnz.org/mh-Qsb_SIH944YPl8wamiGjJgk0=/368x0/https%3A%2F%2Fndhadeliver.natlib.govt.nz%2FNLNZStreamGate%2Fget%3Fdps_pid%3DIE1368444)

![[Benefit cut protest, Timaru] Image: [Benefit cut protest, Timaru]](https://images.digitalnz.org/txzpfIcIA26CTSQs4cpAOtPWZWw=/368x0/https%3A%2F%2Fs3.amazonaws.com%2Fpastperfectonline%2Fimages%2Fmuseum_58%2F108%2F7283.jpg)

![[Department of Social Welfare, Timaru] Image: [Department of Social Welfare, Timaru]](https://images.digitalnz.org/p3HewCHUdNk_GKt_FiMQ7id9SZI=/368x0/https%3A%2F%2Fs3.amazonaws.com%2Fpastperfectonline%2Fimages%2Fmuseum_58%2F110%2Fl2012007059.jpg)