NZ Superannuation since 1898

A DigitalNZ Story by Zokoroa

The elderly In NZ were granted an old-age pension on 1 Nov 1898. This story recounts the journey taken for men and women to receive the original old-age pension, nowadays called NZ Super.

elderly, seniors, senior citizens, pensioners, old-age pension, pension, superannuation, NZ super, retirement, social security, Grey Power, Age Concern

On 1 November 1898, New Zealand granted the elderly an old-age pension, nowadays called New Zealand Superannuation (NZ Super). This story tells the journey taken to receive the pension and the stringent criteria, including open court hearings to attest you were of 'good moral character'. Young looking women over the age of 65 were often a puzzlement for magistrates!

Journey of the old-age pension which was introduced in NZ on 1 November 1898

Puke Ariki

NZ was the first in the British Empire to grant a pension & the first in the world for a means-tested pension

Germany was the first in the world to grant a pension (contributions-based) in 1889, followed by Denmark in 1891

Auckland War Memorial Museum Tāmaki Paenga Hira

Legislation had been passed by MP Richard Seddon's Liberal Government for state to provide for elderly requiring support

(Image: Appreciative old age pensioners meet with PM Seddon & his wife, & Auckland Mayor Arthur Myers, 1905)

Auckland Libraries

1898: International interest

The Liberal reforms "attracted international interest and signified the nation’s distinctive egalitarian ethos" (Te Ara)

Manatū Taonga, the Ministry for Culture and Heritage

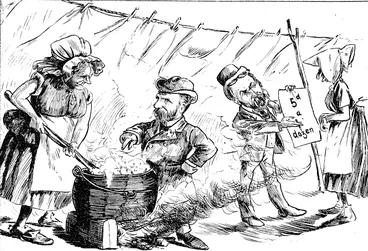

1901: Series of illustrations depicting types of recipients of the old age pension in Auckland

Auckland Libraries

BACK THEN

Old age pensioners collecting social security at a Post Office

Alexander Turnbull Library

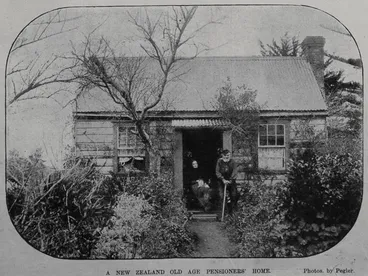

Living on a pension

Manatū Taonga, the Ministry for Culture and Heritage

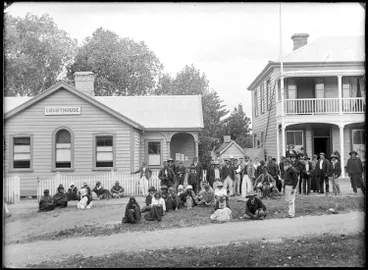

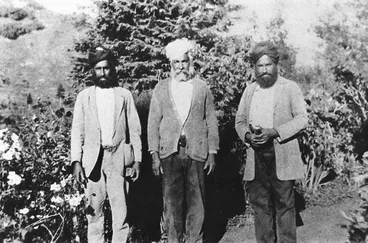

Pensioners group Rawene, 1899

Auckland Libraries

AND NOW

Jean Sandel Retirement Village [poster]

Puke Ariki

Retirees react to new free doctor's visits

Radio New Zealand

Grey Power protest

Manatū Taonga, the Ministry for Culture and Heritage

The elderly - early forms of assistance

Prior to the Old-Age Pension being available in 1898, those aged over 65 were expected to provide for themselves or be supported by their families. However, many older, single workers, particularly single men, had no family connections in New Zealand. Friendly Societies provided financial support to members and their families if they became ill or died. (See Te Ara). A small group of elderly received Imperial or New Zealand war pensions for military service, and some former public servants obtained government pensions on retirement. Those who could no longer work or live independently often became residents of benevolent institutions set up by provincial charitable aid boards from the 1860s (See Te Ara).

Destitute Persons Relief Ordinance 1846 & Acts 1877, 1883 & 1894

Families were expected to provide support

The University of Auckland Library

Friendly Society Act 1854 & Friendly Societies Act 1877

Provided financial support to members and their families if they became ill or died

Palmerston North City Library

Imperial & NZ war pensions

A small group of elderly received Imperial or New Zealand war pensions for military service

National Library of New Zealand

Civil Service pensions, 1858

Some former public servants obtained government pensions on retirement

The University of Auckland Library

Benevolent Institution, Dunedin, 1890s

Some elderly became residents of benevolent institutions set up by provincial charitable aid boards

Manatū Taonga, the Ministry for Culture and Heritage

Colonial Govt pensions, 1868

Lists names and amounts paid per annum

National Library of New Zealand

The long depression years: 1870s - 1890s

After the gold rush years, the NZ economy had slumped into the long depression during the late 1870s until the early 1890s: "There was much hardship, with ‘sweating’ (exploitative labour conditions) in the factories, a lack of jobs for rural workers, and farmers going bankrupt." (See Te Ara). The really destitute elderly could receive assistance under the Hospitals and Charitable Institutions Act 1885, which provided for food rations, medicine, hospital out-patient medical treatment to the destitute, and also the admission of destitute sick, incurable, elderly, orphaned or neglected children, to various charitable institutions.

Long depression years 1870s - 1890s

These seasonal farm workers, pictured in the Illustrated New Zealand News of 1885, were living in rough barracks

Manatū Taonga, the Ministry for Culture and Heritage

Hospitals and Charitable Aid Act, 1885

Provided food rations, medicine, hospital out-patient medical treatment, and charitable institutions

National Library of New Zealand

Forms of support for elderly debated

By 1881 people aged 65 comprised 1.3 percent of the census population, which increased to 2.1 percent in 1891. With the growing numbers of relatively poor elderly people, debate ensued on additional forms of support. Some proposed widening the scope of family responsibility or private charity, whilst others supported expanding the role of Friendly Societies. There was also debate as to whether to replicate the English Poor Law whereby parishes in England and Wales provided relief paid for by levying rate payers. Women’s organisations, such as the National Council of Women, the Women's Christian Temperance Union and the Mothers’ Union. urged governments to support families, women and children (See Te Ara). Furthermore, the temperance movement campaigned against alcohol, arguing it was the cause of poverty, ill health, neglect and abuse of families, immorality, and social and economic instability (See NZHistory).

Charitable support

In the 19th century families in crisis had to depend on charity and sometimes had to beg for money

Manatū Taonga, the Ministry for Culture and Heritage

Friendly Societies

Widening role of Friendly Societies suggested

Nelson Provincial Museum

English Poor Law debated 1866

Parishes in England and Wales provided relief paid for by levying rate payers

National Library of New Zealand

Poor Law debate continues: 1880

"In our opinion this would be a step towards perpetuating the evil which it is intended to remove."

National Library of New Zealand

National Council of Women

Campaigned for social reform including the old-age pension

Archives New Zealand Te Rua Mahara o te Kāwanatanga

Temperance movement

Supporters believed alcohol caused social problems, including poverty and ill health, and wanted to prohibit sales

National Library of New Zealand

Legislative journey for universal pension

Colonial Treasurer Sir Harry Atkinson had proposed a compulsory national insurance scheme in 1882, whereas others proposed a universal pension. The Registration of People‟s Claims Act was passed in 1896 to establish who might be entitled to claim the pension. The Old Age Pensions Bill was vigorously debated during its three readings in Parliament. A strong advocate for the pension scheme was Aucklander William Leys who had published a pamphlet which featured during Parliamentary debates. (See New Zealand Parliamentary Debates, vol. 100 1897, p. 644)

Atkinson proposed national insurance scheme, 1882

National Library of New Zealand

Leys advocated for universal pension, 1895

Aucklander William Leys advocated for a pension

National Library of New Zealand

Registration of People's Claims Act, 1896

The Act was to establish who might be entitled to claim the pension

The University of Auckland Library

The birth of the old-age pension: 1 Nov 1898

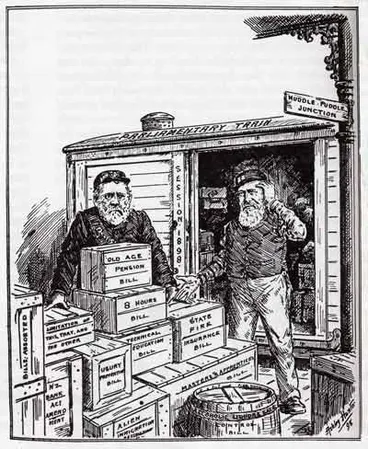

Legislation passed by Richard Seddon’s Liberal government on 1 Nov 1898 was based on the principle that the state had some responsibility for elderly citizens who were not able to provide for themselves. As stated by W.C. Walker during the Parliamentary debates, "The only necessity for a pension Bill is that fortune is so capricious, circumstances so various, family history is so extraordinary, [and] calamities sometimes come down up on people nobody knows how." (See New Zealand Parliamentary Debates, vol.100, 1897, p. 698)

1 Nov 1898: Old-age Pensions Act

The Bill was passed on its 3rd reading after much Parliamentary debate

The University of Auckland Library

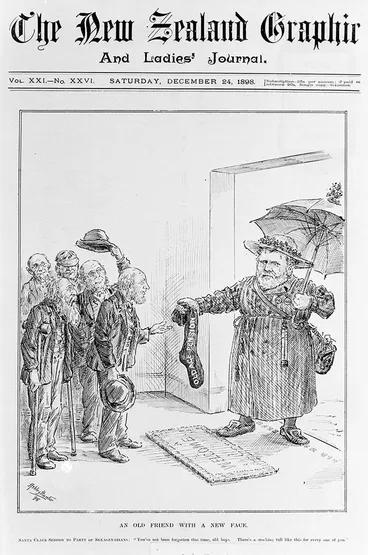

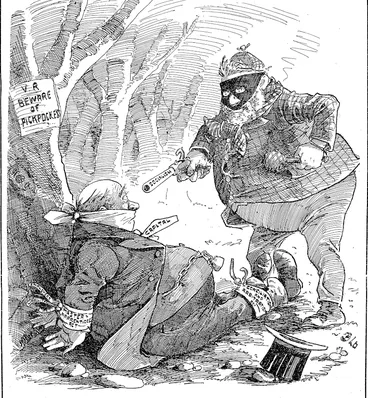

Santa Claus Seddon to party of sexagenarians:

"You've not been forgotten this time, old boys. There's a stocking full like this for every one of you."'

Manatū Taonga, the Ministry for Culture and Heritage

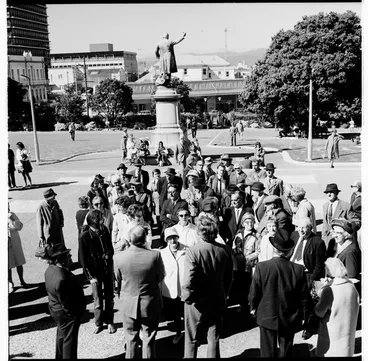

1899: Public gathering of thanks

Meeting held in Dunedin to thank Seddon for the passing the Old-Age Pensions Act

National Library of New Zealand

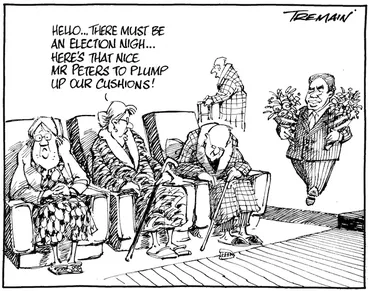

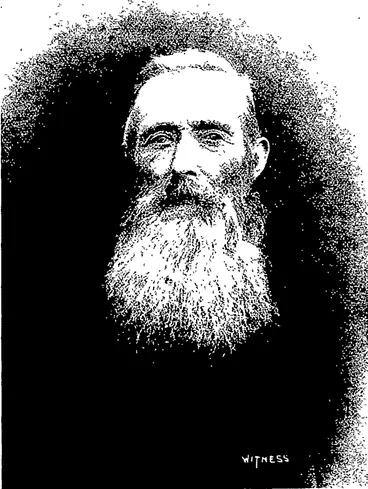

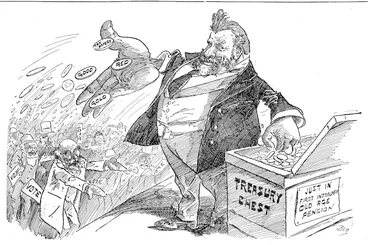

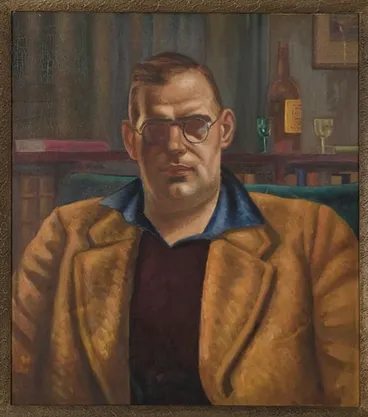

Prime Minister Richard John Seddon

A cartoon showing Prime Minister Richard Seddon after his government passed the Old-age Pensions Act in 1898

Alexander Turnbull Library

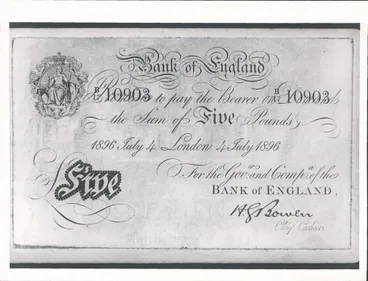

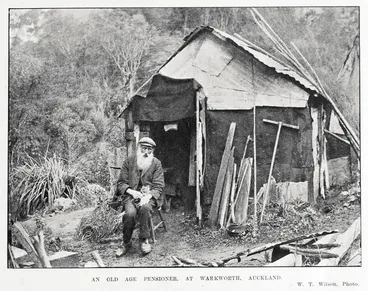

How much was the means-tested pension?

The pension was £18 per year which was about one third of the average wage. It was funded from general taxation and paid in monthly instalments beginning the first day of each month. It was means-tested whereby you could earn up to £34 and have property worth up to £15 to get the full amount. The amount was reduced by £1 for every £1 earned above £34 and for every £15 net capital value of property above £15. Hence, if you earned £52 and above, or had £270 worth of property, you would not receive a pension. Māori were eligible to receive the pension but their shared ownership of land held under customary title meant that claimants had to rely on the Magistrate‟s discretion to grant a pension, until Māori land was excluded in the asset test in 1936.

Pension was £18 per year which was paid on 1st day of each month

Hocken Collections - Uare Taoka o Hākena, University of Otago

Taxes to pay for pension

National Library of New Zealand

About £200,000 budgeted

National Library of New Zealand

Pension was means-tested

Pension was reduced by £1 for every £1 earned above £34 and for every £15 net capital value of property above £15

Auckland Libraries

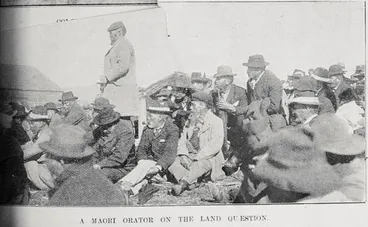

Māori shared ownership of land under customary title

Magistrate's discretion used until Māori land excluded from asset test in 1936

Auckland Libraries

Value of pension versus food rations

Some were concerned as food rations under Hospital and Charitable Aid Institutions Act 1885 were worth more

National Library of New Zealand

Who was eligible?

Men and women had to meet certain criteria to qualify for the pension, including being over 65, earn below a certain income and be ‘of good moral character’ (see NZHistory). However, some were specifically excluded under section 64 of the Act: (1) Māori (the actual words used were “aboriginal natives of New Zealand”) “…to whom moneys other than pensions are paid out of the sums appropriated for Native purposes by the Civil List Act, 1863”; (2) Aliens; (3) Naturalised subjects unless they had been naturalised for at least five years; (4) “Chinese or other Asiatics, whether naturalised."

Various forms of evidence required

National Library of New Zealand

Proof at least 65 years old

National Library of New Zealand

Applicants without birth certificate met difficulties

Disadvantaged were the many Māori whose births had not been registered & immigrants without a birth certificate

National Library of New Zealand

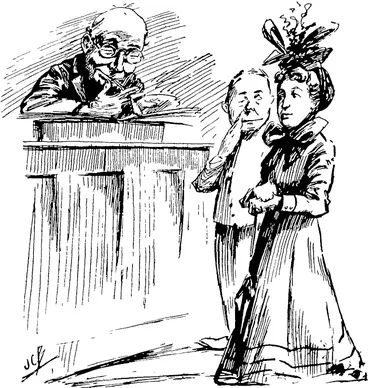

Youthful-looking women puzzling to magistrates!

The Magistrate surmises,"...the youthful bloom upon your cheek is the result of 65 years of hard work..."

National Library of New Zealand

Lived in NZ for 25 years

Periods of absences totalling 2 years acceptable, extended in 1900 to 4 years prior to 1898 with last 12 months in NZ

Manatū Taonga, the Ministry for Culture and Heritage

Eligibility for seamen

Seamen could include periods of employment on a NZ registered ship as long as their home was in NZ

Alexander Turnbull Library

Of good moral character

Applicant to be ‘of good moral character’ and for the preceding 5 years been "leading a sober and reputable life"

National Library of New Zealand

Husband/wife not deserted

Has not deserted spouse for a period of 6 months upwards. (1902 amendment: during last 12 years)

National Library of New Zealand

Children not neglected

Without just cause has failed to provide adequate support for children under 14 years

Manatū Taonga, the Ministry for Culture and Heritage

Prison term restrictions

Could not have a term of 4 or more months in previous 12 years, or 5 years imprisonment during previous 25 years

Manatū Taonga, the Ministry for Culture and Heritage

Chinese and other 'Asiatic' immigrants not eligible

Asians were excluded, whether or not they were naturalised New Zealanders, until the Pensions Amendment Act 1936

Manatū Taonga, the Ministry for Culture and Heritage

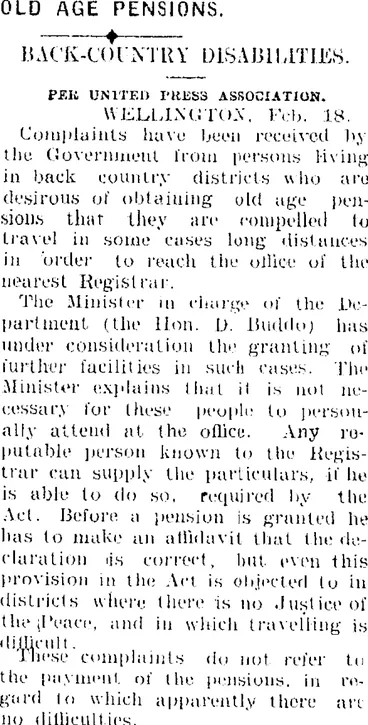

Claiming your pension

Step 1: Fill out a pension-claim form which was filed with Deputy Registrar

A Registrar was appointed to administer the Act and the colony was divided into districts and District Registrars appointed. Each applicant had to fill out a pension-claim form which could be obtained from the Post Office. The form set out the eligibility criteria and each claimant had to make a statutory declaration before a Justice of the Peace, solicitor, Deputy Registrar, or Postmaster affirming the contents are "true and correct in every material point". The form was then sent to the Deputy Registrar for filing and recording in "The District Old-age Pension-claim Register".

Registrar appointed to administer Act

National Library of New Zealand

District Deputy Registrars set up

Colony to be divided into Districts and District registrars to be appointed

National Library of New Zealand

Application forms available at Post Office

National Library of New Zealand

Form sent to Deputy Registrar

National Library of New Zealand

Old-age Pension-claim Register kept by Districts

Deputy Registrar filed claims (new, re-registered, transferred to another district, deceased)

National Library of New Zealand

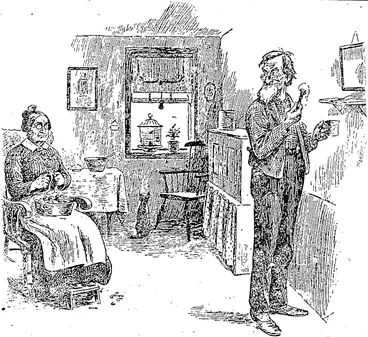

Looking forward to receiving the pension

National Library of New Zealand

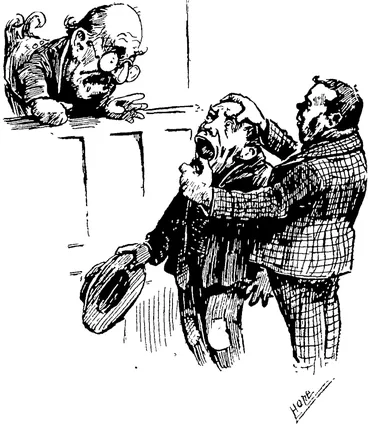

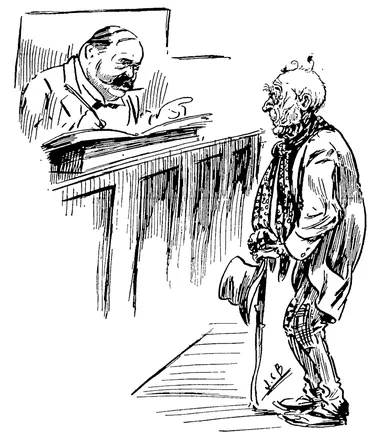

Step 2: Attend an open court hearing

The Deputy Registrar notified the Stipendiary Magistrate who held an open court investigation as to whether the claimant was entitled to the pension, and, if so, for what amount for the first year. Witnesses could be called to testify as to their knowledge of the claimant. The Court's investigations could include a check of the Land Transfer and Deeds Registration Offices registers; Supreme Court records for registrations under Chattels Transfer Act, 1889; the district valuation roll; and the registers and records of the Registrar-General's department.

Courts checked claimants

Stipendiary Magistrates held open Court sessions to check claimant entitled to the pension and, if so, for what amount

National Library of New Zealand

Land registers & Court records investigated

National Library of New Zealand

Newspapers reported on court proceedings

National Library of New Zealand

Pension claimants came from varied occupations

National Library of New Zealand

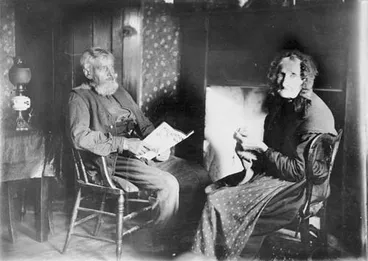

1899: Successful applicant

Elderly man who has received a certificate approving his pension application presents it at a Post Office.

Auckland Libraries

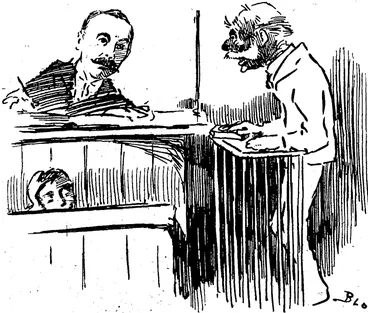

1899: Disqualified applicant

National Library of New Zealand

The 'humours' of court appearances recounted in newspapers

National Library of New Zealand

Step 3: Details recorded on the District Old-age Pension Register

For successful applicants, the Magistrate authorised a “pension-certificate” and the Deputy Registrar entered the pensioner's name and details on the District Old-age Pension Register. The pension-certificate specified the annual amount payable where that was less than the full amount. The Register was a public list and anyone could inspect it on paying a fee of one shilling.

1901: 12,405 registered

In the year to 31st March, there were 12,405 registered, including 1098 granted to Māori. Yearly payment was £211,965.

National Library of New Zealand

Auckland's oldest female pensioner aged 83 (1902)

Auckland Libraries

Auckland's oldest male pensioner aged 87 (1902)

Auckland Libraries

Step 4: Applications renewed annually

Applicants had to renew their "pension-certificates‟ each year to ensure the income and assets tests were still adhered to, as well as the conditions as to character and crime convictions. However, a pensioner could lose entitlements at any time, "if any pensioner is convicted of drunkenness, or of any offence punishable by imprisonment for not less than one month and dishonouring him in the public estimation... could forfeit any one or more of the instalments falling due next after the date of conviction.” (Section 49 of the Act).

Pensioners had to renew annually

Payments affected if convicted of drunkenness, or of any offence punishable by one month or more in prison

National Library of New Zealand

1903: new stricter regulations for pension

National Library of New Zealand

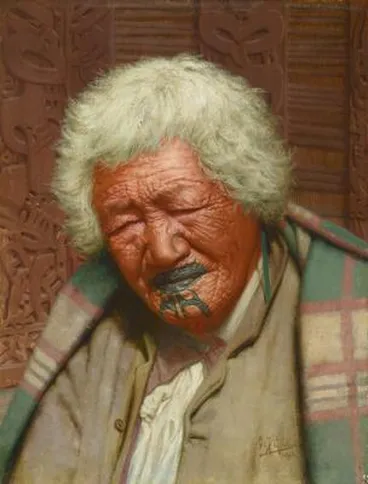

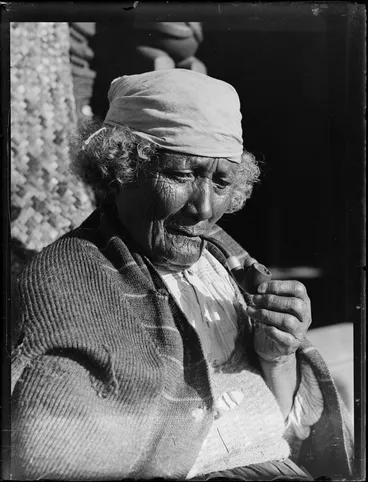

Kapi-Kapi, aged 102 years (1910)

Artist/creator Charles F Goldie

Auckland Art Gallery Toi o Tāmaki

Administration of old-age pensions: 1904 - 1930s

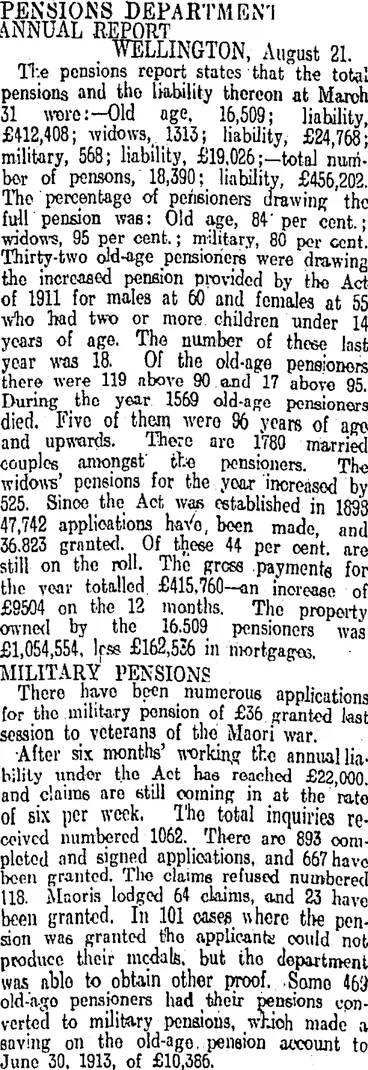

In 1904, the Old Age Pensions Department was established. From 1909-1912, pensions were administered as a division of the Post and Telegraph Department. Then in 1913 the Pensions Department was established which managed pensions for the next two decades.

Old Age Pensions Dpt, 1904

Annual report was covered by newspapers

National Library of New Zealand

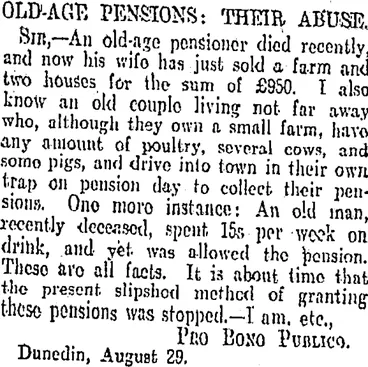

Abuses by claimants continued, 1907

National Library of New Zealand

Pensioners being penalised for drinking debated, 1910

National Library of New Zealand

Post & Telegraph Dept administered pensions, 1909-1912

Alexander Turnbull Library

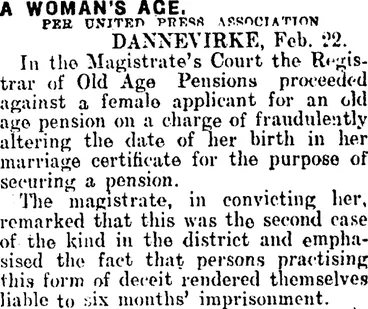

Fraudulent form-filling, 1912

Alteriing date of birth could result in six months' imprisonment

National Library of New Zealand

Pensions Department, 1913

National Library of New Zealand

Local Authorities & private retirement schemes introduced: 1908 -

With the old-age pension in place, New Zealand governments looked for ways to encourage people to provide for their retirement privately rather than expanding the scope of the tax-funded pension. The Local Authorities Superannuation for civil servants had been set up in 1908. Two years later, the National Provident Fund was established for the less well-off with pound-for-pound government subsidies and was administered in conjunction with the registration and supervision of Friendly Societies. Under the Finance Act 1915, individuals contributing to private superannuation funds received deductions from taxable income of up to £100 a year. In 1916 concessions were extended to the investment earnings of superannuation funds, and in 1921 employer contributions qualified for tax concessions.

Local Authorities Superannuation, 1908

The University of Auckland Library

National Provident Fund Act 1910

Provided pound-for-pound government subsidies for those who joined as contributors

Alexander Turnbull Library

Private Super Schemes discussed, 1913

National Library of New Zealand

Govt Superannuitants Association: 1920 -

Collective voice for Government Superannuation Fund (GSF) schemes & National Provident Fund (NPF) Defined Benefit Plan

Nelson Provincial Museum

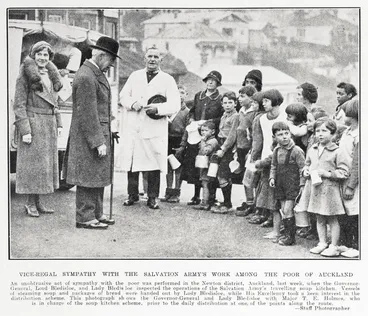

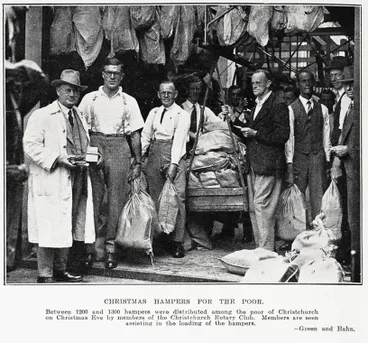

The Great Depression years: 1930s

The Great Depression during the 1930s caused mass unemployment and families struggled to cope, relying on work-relief schemes and charity. In 1934, the Pensions Department gave a five per cent increase in the old age pension, which increased the amount to £43 per annum, and back pay was given for the preceding six months.

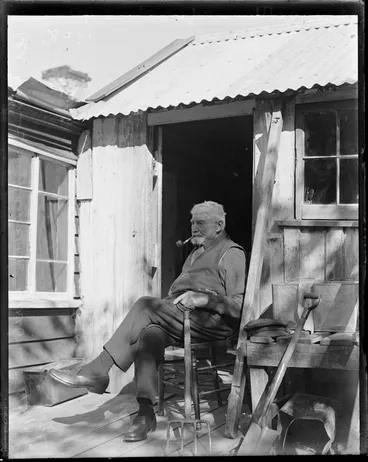

Old miner, aged about 96, Havelock, Marlborough

Alexander Turnbull Library

Where Whangarei's destitute pensioners have spent two 1 winters. The annexe At Kamp. Springs, '". (NZ Truth, 11 July 1929)

National Library of New Zealand

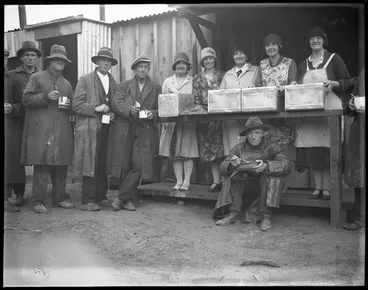

Soup kitchen, Wellington

Alexander Turnbull Library

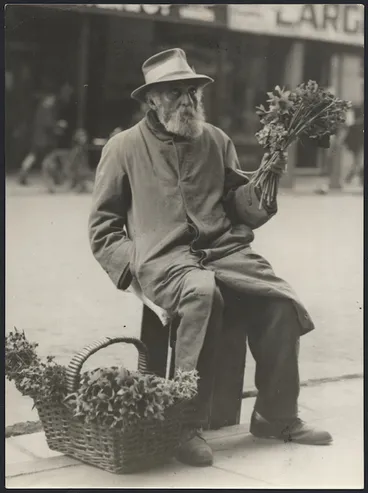

Elderly man selling flowers in Wellington

Alexander Turnbull Library

Unidentified elderly man [tramp?] with swag on his back, rural road, location unknown

Alexander Turnbull Library

Christmas hampers for the poor

Auckland Libraries

Pensions Amendment Act, 1936

Following the election of the new Labour Government in 1935, Michael Joseph Savage led the introduction of a range of social reforms, the building of state houses and improved access to education and health - the ‘cradle-to-grave’ welfare state took shape. Under the Pensions Amendment Act, 1936, the residency requirement to receive the old-age pension decreased from 25 years to 10 years in 1937. Previous restrictions that prohibited 'Asiatic' residents gaining the pension and assets-testing of Māori land were removed.

Michael Joseph Savage led Labour Party to introduce a range of social reforms

Alexander Turnbull Library

Pensions Amendment Act, 1936

Residency decreased from 25 to 10 years.

The University of Auckland Library

'Asiatics' now eligible

'Asiatics’ included Chinese, Indian, Syrian, Singhalese and Lebanese

Alexander Turnbull Library

Māori land no longer assets tested

Alexander Turnbull Library

Payment increased to £58.10s per annum

As of 1 Dec 1936, the maximum amount paid annually for the means-tested benefit increased to £58.10s

Mangawhai Museum

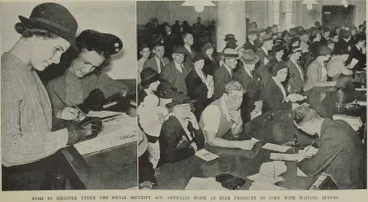

Two-tier changes (60 & 65 years) under Social Security Act, 1938

The Social Security Act 1938 overhauled the pension scheme and extended benefits for families, invalids and the unemployed. It introduced a two-tiered system for payment of the pension: the means-tested Age Benefit at age 60 years (£78 a year) and a small universal Superannuation Benefit at age 65 (£10 a year) effective from 1940. It was also promised that this universal benefit would gradually be increased to match the Age Benefit, but this did not eventuate until 1960. Both payments required 20 years residency with grandfathering of the 10 years for those living in NZ on 15 March 1938. A new Social Security tax of 5% of earnings (one shilling in the pound) was introduced to cover the increased costs of pensions, other social security payments and health.

Social Security Act, 1938

Overhauled benefits & introduced new tax of 5% of earnings (one shilling in pound) for increased benefit costs

Auckland Libraries

Two-tier age eligibility

Means-tested Age Benefit at 60 years (£75 per year) and universal Superannuation Benefit at 65 years (£10 per year)

Alexander Turnbull Library

10-20 years residing in NZ

Both benefits required 20 years residency with grandfathering of 10 years if living in NZ since 15 March 1938

Auckland Libraries

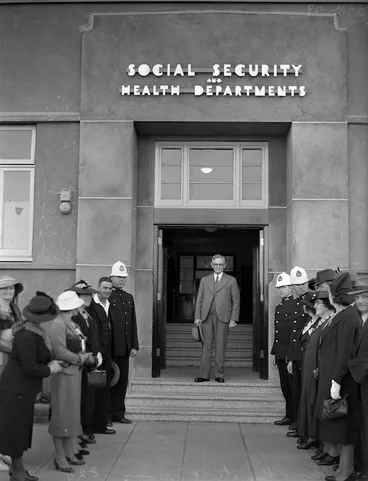

Social Social Department established, 1939

Under the Social Security Act, the Social Security Department was established on 1 April 1939 under the control of Social Security Commission. It replaced the former Pensions Department and absorbed the major portion of the Employment Division.

Social Security Dpt replaced Pensions Dpt

Alexander Turnbull Library

Overseas portability with Australia, 1948

Commonwealth Government discussions on reciprocal pensions in 1938 led to the Social Security (Reciprocity with Australia) Act, 1948. Since then, over the years, portability arrangements for residing overseas exist where reciprocal agreements have been negotiated. (See Work and Income: New Zealand Superannuation).

Benefit rate for single and married: 1950s - 1960s

Over the years, successive amendments raised the amount of the pension and liberalised the conditions for eligibility. During the 1950s and 1960s the Age Benefit for a couple varied between 50 - 60 % of the average gross wage, with a general downward trend. However, the benefit rate for single people rose from 50 to 60 % of the married rate (recognising that single retirees often had higher living costs than couples who were sharing a household).

Age Benefit for a couple varied between 50-60% of the average gross wage

Alexander Turnbull Library

Benefit rate for single person rose from 50 to 60 % of married rate

Alexander Turnbull Library

Social Services: 1950s-60s

The range of social services available during the 1950s - 1960s included Meals on Wheels. and residential housing, such as the Salvation Army Homes, pensioner flats and hospitals for the elderly.

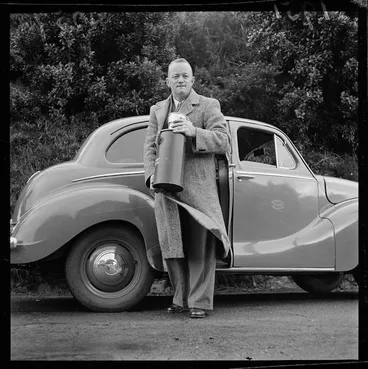

Meals on Wheels, 1951

One of the first Meals on Wheels services was provided by the NZ Otago Old People’s Welfare Council

Alexander Turnbull Library

The Salvation Army Home for Elderly Ladies, 1957

Alexander Turnbull Library

Central Park Hospital for the elderly, 1958

Alexander Turnbull Library

Department of Social Welfare formed 1972

On 1 April 1972, the Department of Social Welfare formed from the amalgamation of the Social Security Department and the Child Welfare Division of the Department of Education. That same year, the Royal Commission on Social Security recommended higher real pension levels, with parallel proposals for increased rates for other benefits. The Age Benefit for a couple increased to around 68 percent of net ordinary time wages. By 1976 the Age Benefit for a couple had risen to over 72 percent of net ordinary time wages. The residence qualification for the Age Benefit (received at aged 60) was reduced to 10 years while Superannuation Benefit (received at age 65 if not eligible for an Age benefit) remained at 20 years.

Dept of Social Welfare formed 1972

National Library of New Zealand

1972 Royal Commission on Social Security

Professor Alan Danks (Univ of Canterbury) was one of the Report's contributors

Manatū Taonga, the Ministry for Culture and Heritage

Pensioners protesting at benefit amount, 1974

Alexander Turnbull Library

Payment increased for Age Benefit (received at 60 yrs)

Amount increased to around 68% and rose to over 72% in 1976

Reserve Bank of New Zealand

Residency for Age Benefit reduced to 10 years

Manatū Taonga, the Ministry for Culture and Heritage

Residency still 20 years for Superannuation Benefit (received at 65 yrs if ineligible for Age Benefit)

Auckland Libraries

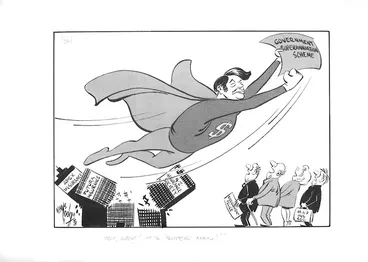

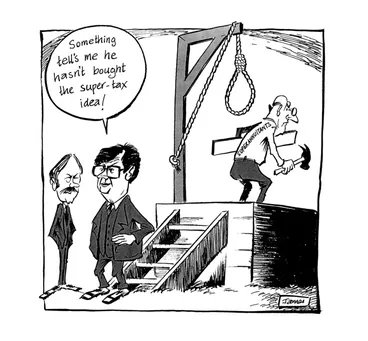

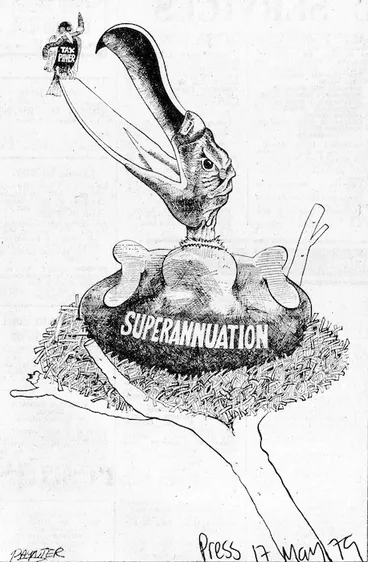

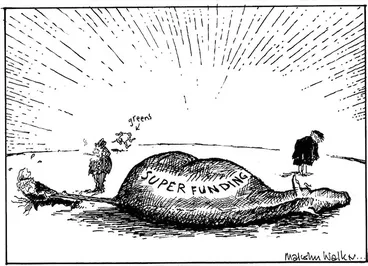

National Superannuation Scheme, 1977 -

In 1975 the third Labour Government set up a compulsory contributory superannuation scheme. Combined contribution rates for employees and employers were to be phased up to 8 percent of earnings, funding individual contributions-related pensions at retirement. The contributory scheme was short-lived and repealed by Rob Muldoon's newly elected National Government in 1976. In 1977, a universal scheme called National Superannuation was introduced to replace the means tested Age Pension and Universal Superannuation Benefit. Later in 1985 the Labour Government introduced a taxation surcharge on the other income of superannuitants. In the first year of the surcharge about 10 percent of superannuitants paid the equivalent of their full superannuation back in surcharge payments, and about 13 percent repaid a partial amount.

In 1975, MP Bill Rowling's Labour Govt introduced compulsory contributory scheme

Alexander Turnbull Library

In 1977, PM Rob Muldoon's National Government introduced a taxable universal scheme called National Superannuation

Palmerston North City Library

Paid 70% of average wage to married people over 60 (increased to 80% in 1978)

Paid a single person 60% of the married pension

Alexander Turnbull Library

No income or asset tests; 10 years residence since aged 16; & no requirement to be actually retired

Auckland Libraries

Video: 1970s campaign promoting NZ for New Zealanders included a scenic bus ride for seniors

NZ On Screen

Cutting back superannuation, 1980s-90s

For details on the extent of the cut-back measures introduced, see Retirement income in New Zealand: the historical context, written by David Preston and commissioned by the Retirement Commission, Dec 2008.

Surcharge: 1985-1998

In 1985 the Labour Government introduced a taxation surcharge on the other income of superannuitants. The surcharge rate was increased in 1991 from 20 to 25 percent and the income exemption lowered so that more superannuitants were affected by the surcharge. The surcharge was removed in 1998 as part of the Coalition agreement of the National-New Zealand First Government. making the pension fully universal. As it is a taxable pension the tax system provides a small degree of claw back from a high income recipient.

Taxation surcharge on other income introduced 1985 & removed in 1998

Alexander Turnbull Library

Tax Concessions: 1988

Tax concessions on contributions to private and occupational schemes were abolished in 1988, as were tax concessions to the superannuation funds. Furthermore, private superannuation paid out from fully taxed funds was tax-free for recipients. For surcharge purposes half of any private pension was counted as income.

Superannuation and taxpayer

A large vulture (Superannuation) is sitting in a nest. There is a small bird (Taxpayer) sitting on the vulture's beak.

Alexander Turnbull Library

Net rate

The net rate for gross pensions had been set at 80% of gross ordinary time wages. However, wage earners on average paid higher tax rates than superannuitants without other income. This meant that by 1978 the net rate for a couple was over 89 percent of net after-tax wages. In 1989 the Labour Government announced it was suspending the 80 percent link of superannuation to wages. The renamed "Guaranteed Retirement Income" was to be adjusted by the lower of price and wage movement, and intended to move in a band of between 65 and 72.5 percent of net wages.

"Guaranteed Retirement Income", 1989

To be adjusted by the lower of price & wage movement, & move in a band of between 65 - 72.5 % of net wages

National Library of New Zealand

Eligibility age raised to 61 years (1992) & 65 years (2001)

In 1990 the new National Government simplified the residency requirement to 10 years, with 5 after age 50. The age of eligibility increased to 61 in 1992, then gradually increased to 65 between 1993 and 2001 under the New Zealand Superannuation and Retirement Income Act 2001.

Age of eligibility increased to 61 years in 1992

Manatū Taonga, the Ministry for Culture and Heritage

Eligibility raised to 65 years: Superannuation Act 2001

The age of eligibility gradually increased to 65 between 1993 & 2001

Alexander Turnbull Library

Restructuring of NZ Super governance: 1992 -

The Minister for Seniors position was established on 24 July 1990 as a post separate from Social Welfare. The Department of Social Welfare was restructured in 1992 to create business units. Later on, following the merger of business units, Work and Income (WINZ) was formed. Since 1 October 1998, the National Superannuation Scheme has been administered by WINZ. The Ministry of Social Development (MSD) was established with the amalgamation of the Ministry of Social Policy and WINZ on 1 Oct 2001. The Office for the Seniors was established within MSD and has the role of being the primary advisor to the Government on issues affecting older people. Senior services have been administered by Work and Income (WINZ) since 1 March 2010.

See:

Minister for Seniors established on 24 July 1990 separate from Dept of Social Welfare which restructured on 1 May 1992

Business Units created: NZ Income Support Service, NZ Children & Young Persons Service, NZ Community Funding Agency

Alexander Turnbull Library

On 1 Oct 1998, super administered by Work & Income (WINZ) which had been formed by merging business units

(Merger of Income Support with NZ Employment Service, Community Employment Group & Local Employment Co-ordination)

Manatū Taonga, the Ministry for Culture and Heritage

1 Oct 2001: Ministry of Social Development (MSD) established with amalgamation of the Ministry of Social Policy & WINZ

The Office for Seniors was located in MSD & Senior services were provided by WINZ from 1 March 2010

Christchurch City Libraries

Guardians of NZ Super Fund estab. 2001

Govt makes contributions to an investment fund - NZS Fund - to pre-fund portions of its future expenses

National Library of New Zealand

Retirement Commission transferred to the Minister of Commerce, 1 July 2011

Now renamed Commission of Financial Capability, it is an independent Crown agency helping NZders prepare for retirement

Radio New Zealand

Compulsory retirement at 65 illegal, 1999 -

From 1 February 1999, it became unlawful under the Human Rights Act 1993 to discriminate on the ground of age in employment against people 16 years or over and retirement at aged 65 was not longer compulsory. Compulsory retirement was regarded as a form of age discrimination. See: Beehive: "Beyond 1st February - Managing An Aging Workforce" Conference, 19 Nov 1998)

Retirement at 65 no longer compulsory from 1 Feb 1999 under the Human Rights Act 1993

Manatū Taonga, the Ministry for Culture and Heritage

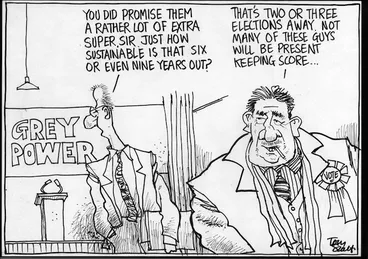

Lobby Groups: Grey Power and Age Concern

Groups representing the interests of older people include Grey Power New Zealand and Age Concern New Zealand.

Grey Power:

Formerly known as the Auckland Superannuitants Association, Grey Power was started in February 1986 to campaign for the abolishment of the surtax introduced on superannuitants' other income. Following media attention, similar organisations formed elsewhere which led to the creation of the Grey Power New Zealand Federation Inc, which is a voluntary subscriptions-based organisation. It's brief has since widened to include the welfare and well-being of those in the 50 plus age group.

Grey Power, 1990

Protested at the surtax on the benefiit and the repealing of the married rate being 80% of the net average wage

Alexander Turnbull Library

Grey Power, 2005

Alexander Turnbull Library

Grey Power, 2008

Grey Power wanted an independent body set up to review the way superannuation is calculated

Manatū Taonga, the Ministry for Culture and Heritage

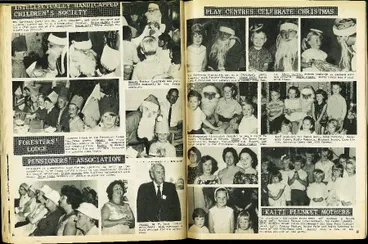

Age Concern:

Age Concern is a community based not-for-profit organisation dedicated to enhancing quality of life for older people. It's earliest beginnings was in 1948 when the Otago Old People’s Welfare Council was set up to provide information, a drop-in centre, and home support services including one of the first Meals-on-Wheels services in NZ. With other councils setting up similar services, the need for national coordination led to the National Old People's Welfare Council being formed in February 1972, which officially became Age Concern New Zealand in 1991.

Age Concern

National Library of New Zealand

Nowadays: NZ Super

For current information on eligibility criteria and the amount received, check:

Work and Income: Seniors: https://www.workandincome.govt.nz/eligibility/seniors/index.html

As amount received is taxed, if have other income (excluding private schemes) this will affect tax code used

Number of NZ retirees on $100k passes 30,000

Radio New Zealand

Amount received is not impacted by work-related, employer-provided and private schemes or savings

NZers will increasingly rely on private savings in retirement

Radio New Zealand

New residence criteria based on the number of years lived in NZ was introduced from 1 July 2024

[Graceful ageing] 27 August, 2004

Alexander Turnbull Library

KiwiSaver, 2006 -

The KiwiSaver Bill (2006) established the KiwiSaver scheme which is a voluntary savings scheme to encourage long-term savings so as to increase financial independence, particularly in retirement. It was designed to complement New Zealand Superannuation.

The KiwiSaver Bill (2006) established the KiwiSaver scheme to increase financial independence, particularly in retiremen

The voluntary savings scheme was designed to complement New Zealand Superannuation

Alexander Turnbull Library

Supergold Card: 2007 -

People aged 65 and over automatically qualify for the SuperGold card, introduced in 2007 by Associate Minister for Senior Citizens Winston Peters. (See: Beehive: Supergold Card for seniors unveiled, 12 Nov 2006). Cardholders are eligible for subsidised or free public transport, discounts at various businesses, and concessions on local and central government services.

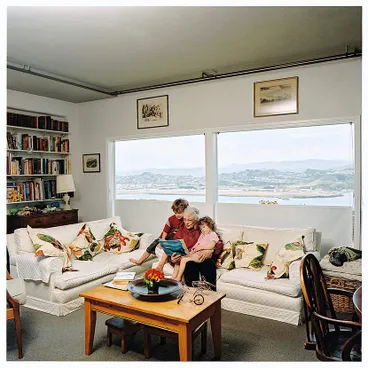

Residing in NZ - 'Aging in place' policy

The New Zealand Positive Ageing Strategy was launched in 2001, to provide a government framework to promote positive ageing and participation for older people in New Zealand. The Health of Older People Strategy was released in 2002 and updated with the Healthy Ageing Strategy in 2016 whose vision is that ‘older people live well, age well, and have a respectful end of life in age-friendly communities’. Older people are encouraged to live in their own homes for as long as they can in order to enhance their sense of independence and self-reliance, and reduce the need for institutional care. See: Ministry of Social Development: Positive Ageing Goals and Key Actions

"Aging in place" policy: Older adults remain in their homes & communities rather than a care facility

Forms of assistance include community support, winter energy payment towards heating, household help & mobility aids

Palmerston North City Library

Don Murray Te Puke September 2012

Tauranga City Libraries

Senior Citizens Society bingo, Christchurch North Methodist Parish

Christchurch City Libraries

St Luke's group : digital image

Wairarapa Archive

There has been an increased demand for smaller houses and sections for senior citizens

They may move to retirement villages, ‘granny flats’ on relatives’ property or kaumātua flats on marae

Manatū Taonga, the Ministry for Culture and Heritage

Retirement village

Manatū Taonga, the Ministry for Culture and Heritage

Granny flat

Manatū Taonga, the Ministry for Culture and Heritage

Housing provides new beginning for Waitara kaumātua

Te Puni Kōkiri

Older people assessed by their local district health board as unable to look after themselves may need long-term residential care in a rest-home or hospital. This may be subsidised by the Ministry of Health following a financial means test. (See: Work and Income: Residential Care Subsidy)

Others assessed by local district heath board may need long-term residential care in a rest-home or hospital

Christchurch City Libraries

Lunch service at a rest home in New Brighton

Christchurch City Libraries

Rest-home staff

Manatū Taonga, the Ministry for Culture and Heritage

Staff and residents at a rest home in New Brighton

Christchurch City Libraries

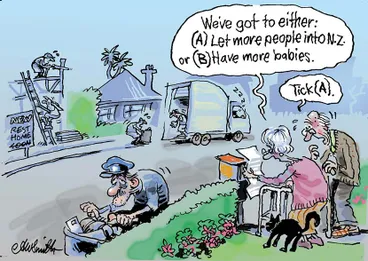

The debate continues on pensioner age: raise / lower / status quo

The Super Summit was held on 21 March 2024 in Wellington hosted by Te Ara Ahunga Ora Retirement Commission. For an account of the issues discussed by the panellists to help shape the future of NZ Super, including age of eligibility, see Te Ara Ahunga Ora Retirement Commission: NZ Super: Pension tension: Summing up the Super Summit The paper restates the Retirement Commission’s position that the age of eligibility should stay at 65 for now.

By July 2022 there were 842,000 people aged 65+ which will likely increase to 1 million by 2028 (NZ Stats)

The number of people aged 65+ could reach 1.3 million around 2040, & 1.5 million by the 2050s

Manatū Taonga, the Ministry for Culture and Heritage

The 65–69 age band continues to account for the majority of NZ's older workforce

This workforce is projected to continue to be predominately male (Office for Seniors)

Manatū Taonga, the Ministry for Culture and Heritage

Business of Ageing 2023 report (July 2024) estimates in 2071 seniors will earn $30.7 billion & pay $54.6 billion tax

They will also do unpaid work (c$98.6- $113.9 billion) to contribute to the economy & spend c.$176 billion

Alexander Turnbull Library

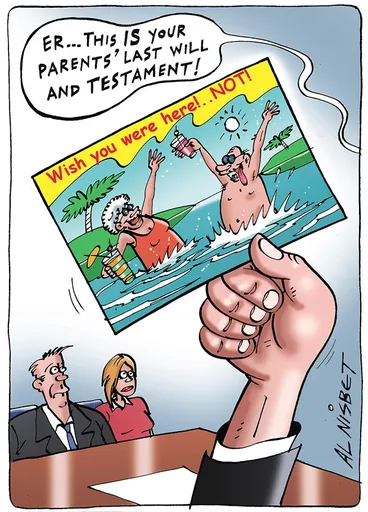

Cartoon reflects that In 21st century its less common for ageing parents to preserve bulk of their assets for offspring

Manatū Taonga, the Ministry for Culture and Heritage

Further information:

Government Superannuation Fund Authority: www.gsfa.govt.nz

New Zealand Superannuation: www.seniors.msd.govt.nz.

Office for Seniors:: https://www.officeforseniors.govt.nz/

Te Ara Ahunga Ora Retirement Commission which helps New Zealanders prepare financially for their retirement: https://retirement.govt.nz/

Work and Income: New Zealand Superannuation: https://www.workandincome.govt.nz/eligibility/seniors/superannuation/index.html

This DigitalNZ story was compiled in 2022 & updated in July 2025

![Jean Sandel Retirement Village [poster] Image: Jean Sandel Retirement Village [poster]](https://images.digitalnz.org/3MylkzHXNBA6XQBIhKcKmGyZu0U=/368x0/https%3A%2F%2Fcollection.pukeariki.com%2Frecords%2Fimages%2Flarge%2F86432%2Fee9e5ee8364174a5cf025fe8ec9b5e3b423ed7c6.jpg)

![Bowring, Walter Armiger, 1874-1931 :A vote in the hand is worth two in the bush (old age pensions.) The Right Hon R J Seddon, P.C., LL.D. (Premier of New Zealand). Press portraits no 1 [Christchurch; Christchurch Press Co Ltd, 1899?] Image: Bowring, Walter Armiger, 1874-1931 :A vote in the hand is worth two in the bush (old age pensions.) The Right Hon R J Seddon, P.C., LL.D. (Premier of New Zealand). Press portraits no 1 [Christchurch; Christchurch Press Co Ltd, 1899?]](https://images.digitalnz.org/IDI2CqCT39ypivZKE4Mf7Z8jXiE=/368x0/https%3A%2F%2Fndhadeliver.natlib.govt.nz%2FNLNZStreamGate%2Fget%3Fdps_pid%3DIE183946)

![Unidentified elderly man [tramp?] with swag on his back, rural road, location unknown Image: Unidentified elderly man [tramp?] with swag on his back, rural road, location unknown](https://images.digitalnz.org/jsjnMjHMFxlxvkSrMwW_2ORmbZs=/368x0/https%3A%2F%2Fndhadeliver.natlib.govt.nz%2FNLNZStreamGate%2Fget%3Fdps_pid%3DIE6677684)

![New Zealand Labour Party: What N.Z. Labour means to you, written and arranged by David Wilson, National Secretary, N.Z. Labour Party. Pictorially portrayed by "Fox", "The Standard" cartoonist. Wellington, Printed by the Standard Press, Marion Street, Wellington N.Z., [1938]. Image: New Zealand Labour Party: What N.Z. Labour means to you, written and arranged by David Wilson, National Secretary, N.Z. Labour Party. Pictorially portrayed by "Fox", "The Standard" cartoonist. Wellington, Printed by the Standard Press, Marion Street, Wellington N.Z., [1938].](https://images.digitalnz.org/pbsnCYO1T05cxySLNzlIUWZX1a8=/368x0/https%3A%2F%2Fndhadeliver.natlib.govt.nz%2FNLNZStreamGate%2Fget%3Fdps_pid%3DIE25834162)

![New Zealand Labour Party: Ten years' progress 1935-1945. Secure your future - vote Labour! Christie Print [1946]. Image: New Zealand Labour Party: Ten years' progress 1935-1945. Secure your future - vote Labour! Christie Print [1946].](https://images.digitalnz.org/2a2Q4RN39fdj5ooWz1V2TCcjxC4=/368x0/https%3A%2F%2Fndhadeliver.natlib.govt.nz%2FNLNZStreamGate%2Fget%3Fdps_pid%3DIE25833919)

![[Graceful ageing] 27 August, 2004 Image: [Graceful ageing] 27 August, 2004](https://images.digitalnz.org/ZxgyW78WH-eaAvS8zFA6QRZPYio=/368x0/https%3A%2F%2Fndhadeliver.natlib.govt.nz%2FNLNZStreamGate%2Fget%3Fdps_pid%3DIE868270)